Securing a construction loan is different from getting a standard mortgage. Because you are borrowing money for a house that doesn’t exist yet, lenders require more documentation to verify that the project is feasible and low-risk.

At Dwelcore, we know that the “secret weapon” to a fast approval is a professional, builder-ready set of plans. When your lender sees detailed documentation, they see a safe investment.

Here is your essential checklist to get your financing approved and your project started.

The “Bank-Ready” Packet

These are the documents that prove your project is real and viable.

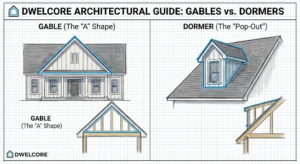

1. Finalized Architectural Plans You cannot get a loan on a sketch. Lenders require detailed blueprints that show the floor plan, exterior elevations, rooflines, and electrical/plumbing schematics.

- The Dwelcore Advantage: Our plans are drafted to meet professional building standards, giving lenders the confidence to approve the project’s design and resale value immediately.

2. Comprehensive Material List (Specs Sheet) This is a breakdown of everything that will go into the house—from the type of roofing and siding to the specific flooring and cabinetry.

- Why it matters: It proves to the bank that your budget is accurate. Guessing on materials is the #1 cause of loan rejection.

3. Fixed-Price Builder’s Contract You need a signed agreement with a licensed general contractor that includes the total project cost, a draw schedule (when they get paid), and a firm start/end date.

4. A “Cost-to-Complete” Budget This is a line-item spreadsheet showing every cost associated with the build. It must match your material list and builder’s contract.

5. The “As-Completed” Appraisal Once you submit your plans and contract, the lender will order an appraisal to estimate what the home will be worth after it is built. Your loan amount is usually based on this future value.

The “Borrower-Ready” Packet

These documents prove you are ready to take on the project.

6. Proof of Land Ownership You must provide the deed to your lot or the purchase contract if you are currently buying it. If you own the land, its value can often be used as collateral or part of your down payment.

7. Builder Credentials Banks won’t lend money to an unproven builder. You will need to submit your builder’s license, proof of liability insurance, and sometimes a resume of their past projects.

8. Down Payment (Liquid Funds) Construction loans typically require a down payment of 20–25%. You will need bank statements to prove these funds are available.

9. Personal Financials Just like a regular mortgage, be ready to provide 2 years of tax returns, W-2s, current pay stubs, and a credit report to verify your debt-to-income ratio.

10. Permits & Site Approvals Before the bank releases the final funds, they often require proof of local building permits, zoning approvals, and utility connections (like well/septic or city water).

Final Tip: Don’t DIY the Paperwork

The biggest bottleneck in construction lending is incomplete documentation. By purchasing a complete plan set from Dwelcore and working with a pro builder who can provide a fixed contract, you essentially hand the lender a “finished package,” drastically reducing the time it takes to get from application to groundbreaking.